Consumer Prices Rise In September

New inflation data released on Thursday showed that consumer prices climbed far more quickly than expected with a rise of .4% in September (according to the Bureau of Labor Statistics) as inflation pressures continue to weigh on retirees and the economy at large.

The food index alone rose 0.8% for the month and is up 11.2% from a year ago. That increase helped offset a 2.1% decline in energy prices that included a 4.9% drop in gasoline. Energy prices have moved higher in October, with the price of regular gasoline at the pump nearly 20 cents higher than a month ago, according to AAA.

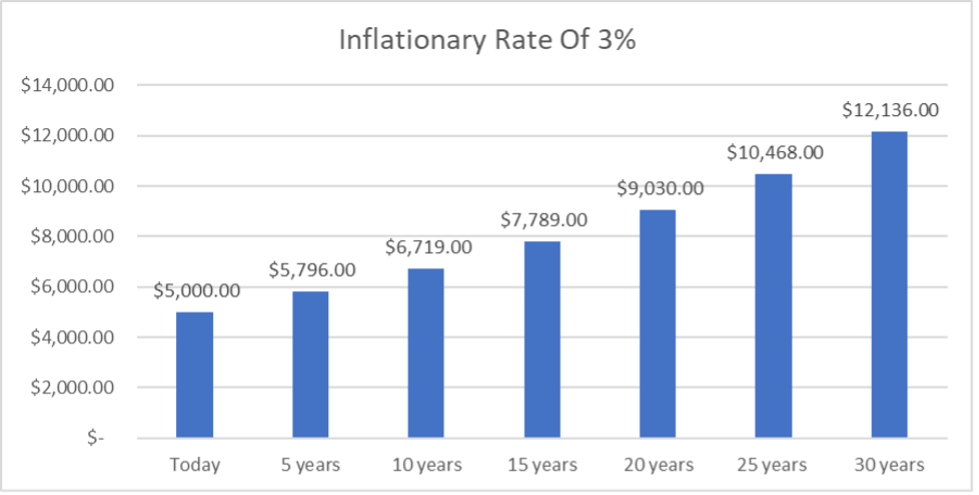

As you can see, inflation can erode the value of your money and create a stressful and unpredictable retirement. Did you know to have the same $5,000 purchasing power today, you will need $6,719 in 10 years adjusting for a more modest 3% inflationary rate? Inflation could be threating your ability to maintain your lifestyle throughout retirement. This chart shows how much you will need in your future retirement years based on this 3% inflation rate. How are you combating inflationary risk?

Depending on how you prepare, retirement can be the most rewarding or stressful time of your life. To answer some of your questions about inflation and retire on your terms,

Contact us or Call 860-757-3644 for a complimentary no obligation consultation.

At Retire Safety First we believe everyone has a right to a safe, secure and predictable retirement.

Our goal is to remove the fear and uncertainty out of retirement, to provide a safe retirement.